Business strategy

A guide to managing currency risk

What is currency risk?

As a business trading internationally, you may be exposed to the volatility of the foreign exchange markets. If your currency exposure is not managed properly, this can be highly damaging to your budget, margins, profits and overall business goals.

Currency risk, also known as exchange rate risk, is the potential for financial loss that arises from fluctuations in currency exchange rates. Exchange rates are constantly fluctuating based on a variety of economic and political factors, such as inflation, interest rates, government policies, and geopolitical events.

The global FX market trades $7.5 trillion per day, a volume that is 30 times greater than daily global GDP. It’s estimated that over 95% of these trades are by financial investors / speculators, which are a key driver behind currency volatility.

SMEs are particularly vulnerable to exchange rate risk because they often lack the foresight, resources and expertise to effectively manage it. A sudden shift in exchange rates can significantly impact their bottom line, especially if they do not have hedging strategies in place. This can make it difficult for SMEs to forecast future cash flows, price their goods and services competitively, protect profit margin integrity, and remain financially stable.

What is currency risk management?

Exchange rate management is the process of identifying, assessing, managing the potential impact of currency fluctuations on your business.

A range of hedging techniques are available such as forward contracts, market orders, and options. When deciding what hedging strategy may be right for you, it is important to consider:

- Do you have a budget rate to protect?

- How flexible is your pricing (could you pass additional costs onto your clients if required?)

- How important is profit margin integrity?

- The visibility you have for future currency requirements.

You may also need to find a compromise between the ability to:

- Protect downside risk

- Engage in upside market movements

- Limit margin call risk

- Not be over / under hedged.

In order to fully understand the potential impact of currency risk on your business, and to understand all the considerations involved including the strengths and weaknesses of each hedging product, you may want to refer to an expert such as Smart Currency Business.

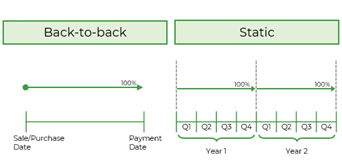

The below tables shows some different ways forward contracts can be employed:

Why should businesses manage their currency risk?

In 2022, the pound fell from 1.36 to 1.03 against dollar before recovering (fluctuating in total over 24%). Against the Euro, we’ve seen a high of 1.21, and a low of 1.11 (fluctuating 9%).

With the ongoing war in Ukraine, rising global inflation, rising interest rates, recession worries and more, this volatility has continued deep into 2023.

As a business with currency exposure, ask yourself the following questions:

- Do you chase the ‘best’ exchange rate or manage your currency exposure effectively?

- What effect would a 10% movement in exchange rates (against you) have on your profit margins?

- Do you have a currency risk management policy in place to help you manage your currency exposure and make informed decisions?

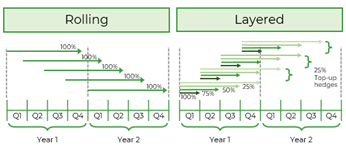

Below is an example of a UK company that buys its goods from Asia in USD. The business did not manage its currency risk. This table details the impact an 8% fall in the GBP/USD exchange rate had on their underlying profitability and sales.

By failing to hedge its currency exposure from the outset, an 8% fall in the value of the pound has reduced the company’s operating profits by nearly 90%, resulting in a direct impact on their available cashflow. To maintain the same level of profitability, the company would need to increase sales significantly in order to offset this loss.

Why do businesses fail to manage their currency exposure?

We have come across many businesses that do not manage their currency risk for several reasons:

- The business owner doesn’t have the time, knowledge, and experience to manage this risk proactively.

- Currency exposure is not seen as a significant risk to the business and the business owner is often unaware of the potential losses it could face.

- The systems used to value and report the risk are inadequate.

- The business is solely focussed on the spot rate at the time and is always looking to benefit on 100% of their currency exposure, should exchange rates move in their favour.

Business often post foreign exchange losses, which have occurred when they’ve only tried to improve their spot price (usually by 0.1% – 0.2%) without considering the implications of a much larger (3% – 10%) market movement over a period of time.

Should you base your decisions on currency predictions?

Alternatively, businesses may try to base their decisions on predictions about what will happen to currencies in the future. However, not even the experts can accurately foresee where the market will move next, so making any decisions on currency forecasts can be dangerous.

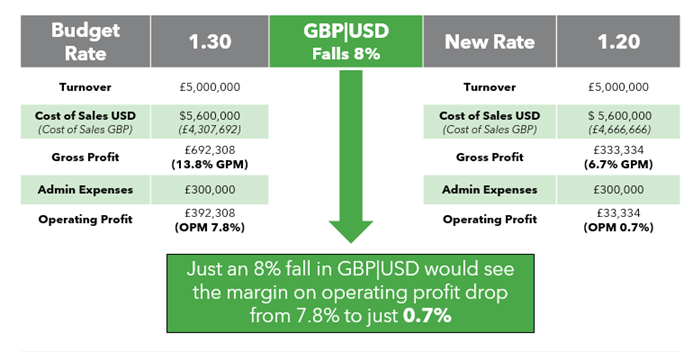

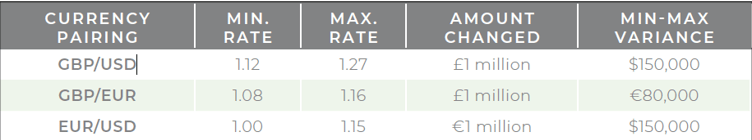

Below were rate predictions from major banks for quarter two of 2023 (April – June) and the possible impact on your budget. If you were exchanging £1 million for USD, the predictions carry a disparity of $150,000, and for EUR a disparity of €80,000. This large disparity between predictions shows how unreliable they can be.

Here at Smart Currency Business, we help companies create long-term currency risk management strategies, utilising your financials, KPIs and business objectives to ensure currency volatility does not affect your ambitions. Via our personal dealing service, advanced online platform, in house analysts, and reporting tools, you will receive all the support you need to try and do the best for your business.

Gerald Edelman works with Smart Currency Business

No matter how large or small your currency exposure is, business owners and their finance teams should always take the time to evaluate their foreign exchange risk.

At Gerald Edelman, we have partnered with currency risk management specialist, Smart Currency Business, who can work alongside your company to help develop your currency strategy and policy. Smart’s personal dealing service will help you regularly review and monitor these. This is to ensure they are fit for purpose and that you are protecting your cashflow and profit margins as best as possible.