How to check if a business is VAT registered

Why check if another company is VAT registered?

You may wish to confirm that the business you are dealing with is VAT registered for a variety of reasons. If you traded with the EU before 1 January 2021, you may be familiar with the EU wide site where you can check an EU business’s VAT number. While that is no longer an option, you can still check a UK VAT number.

A VAT registered business can only reclaim VAT if they have a proper tax invoice from their supplier, this should include their VAT number; if it doesn’t have a VAT number or the VAT number is invalid then you cannot reclaim any VAT and HMRC will disallow it even if you have paid it over to your supplier. HMRC do not consider VAT incorrectly charged to be VAT so it is helpful if you can confirm that the VAT number is correct.

If you are submitting a VAT return for a VAT repayment, this is more likely to be queried by HMRC than payment returns. Checking VAT numbers on the invoices is a basic check carried out by HMRC so you can pre-empt this by confirming the numbers yourself.

How to check if a business is VAT registered

It is difficult to confirm if a business is VAT registered without their VAT number. Although there are various websites where you can enter a business name and they will give you their VAT number, these are not official government websites and the information may be incomplete or incorrect.

If you have their VAT registration number; it is a simple check to ensure it matches the business you are dealing with. Click here.

You can enter the VAT number and this will confirm the business name and the address, as per HMRC’s records. If you wish to keep a copy of this check or some reference that you have carried out this task, you can also enter your own VAT number and the site will allocate a reference number to this request.

If you don’t have their VAT number; there is no official way to confirm if a business is VAT registered. A good starting point is to ask your supplier to issue an invoice containing their correct VAT number but there are also several websites that will allow you to enter a company name and it will give you their VAT number, if they have one. If you enter ‘VAT number search’ into your search engine, some of these sites will appear. These sites may show old, de-registered VAT numbers and, if the company is a member of a VAT group, their number may not show up.

Once you have a VAT number from here, you can then check it is correct on the government website.

It is an offence to charge VAT when a business is not VAT registered and, if they’re found to be charging VAT, HMRC can charge them a penalty of up to 100% of the VAT incorrectly charged.

As previously stated, if you have paid over the VAT element of an invoice, this is not considered VAT by HMRC so will be disallowed. HMRC are also likely to open an enquiry into your supplier.

How to check an EU VAT number

The EU wide site has a system called VIES (VAT Information Exchange System),that allows a business to validate any EU VAT number.

There is a simple website that allows you to check an EU VAT number but, you need another EU VAT number to do so. This is helpful for UK businesses that may be registered in the EU; some EU countries have two levels of VAT number and so they are not automatically entered onto this system, if their number does not show up on the site then they are not registered for intra-EU trading (this will not apply to trading outside the EU).

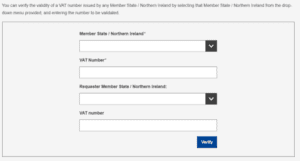

By clicking on the above link, you enter the country of your supplier in the first box and their VAT number (without the country identifier) in the second. You will need to enter your country in the third box and then your VAT number in the final box. The country codes are in alphabetical order by the VAT number country code (for example Spain is near the top under ES).

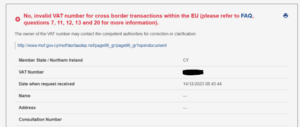

If the number is not registered for cross border transactions, you will get the message below.

If you don’t have their VAT number; there is no official way to confirm if a business is VAT registered. A good starting point is to ask your supplier to issue an invoice containing their correct VAT number but there are also several websites that will allow you to enter a company name and it will give you their VAT number, if they have one. If you enter ‘VAT number search’ into your search engine, some of these sites will appear, many of these have the option to search EU companies too.

Summary

| VAT Number source | I have VAT number | I don’t have VAT number |

| UK | https://www.gov.uk/check-uk-vat-number | Call the company to request their VAT number or web search ‘VAT number search’ |

| EU | https://ec.europa.eu/taxation_customs/vies/#/vat-validation | As above. |

For more specialist VAT advice, please contact us.

Let’s get started

Contact page

Contact Us