Beyond Compliance

International Services

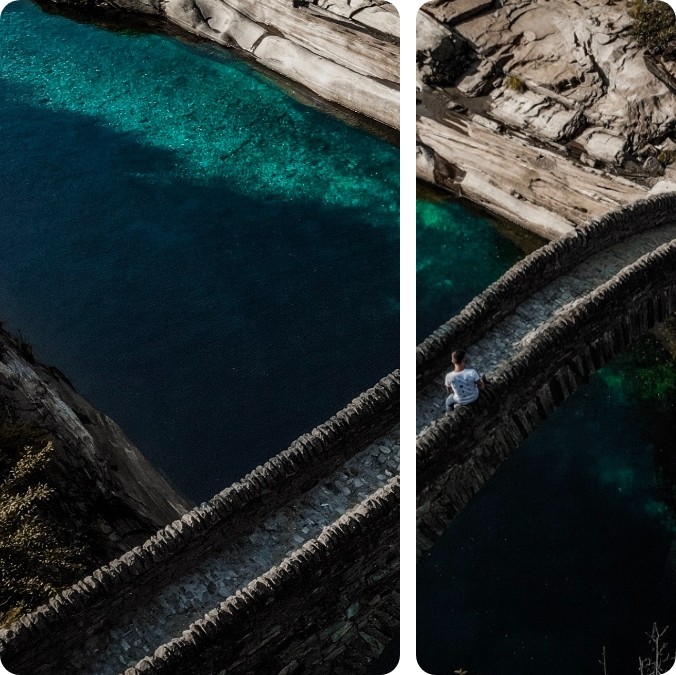

Fulfil your international ambitions

Whether you are moving to the UK, leaving the UK, investing in the UK or using the UK as a springboard to expand internationally, we can help you navigate the challenges and achieve your goals.

At the core of our international services, we provide expert tax advice tailored to your individual or business situation – taking into consideration the regulations and complexities to ensure you can continue to live, work, and invest seamlessly across borders.

INTERNATIONAL SERVICES

How can our international business advisers help?

Get in touch

There’s a lot to consider when working, trading, living and investing cross-border.

At Gerald Edelman, we strive to understand your motivations so we can tailor a watertight plan to fulfil your ambitions. Our Partners will work with you to uncover opportunities, minimise risks and determine your next best step at each stage of the journey.

We’d be happy to arrange a free consultation – simply fill in the enquiry form or call us on the number below.

Call us

+44 (0)20 7299 1400Get in touch

Submit

OUR INTERNATIONAL ALLIANCE

XLNC

Our international offering is strengthened through our membership with XLNC. We are also the founding members of XLNC and through this alliance we have access to a network of accounting, law and management consulting firms from over 85 countries across the globe. This means you can get access to professionals that understand the market you wish to expand to, giving you the best advice.

WHY CHOOSE US

Why Gerald Edelman?

Our team works closely with individuals, businesses, private clients and property investors alike to understand their needs, map out their best options and develop a strategy to deliver their goals as swiftly as possible.

Our services help you fulfil your international ambitions, whether that’s providing pre arrival tax planning and advice on complex international tax affairs for individuals, complete UK tax service to non-resident or UK resident and non-domiciled individuals, assisting property investors on the best structure for property ownership, assisting offshore trustees or beneficiaries on the UK taxation of offshore trusts or supporting businesses with their international growth strategies.

Get in touch via the contact form above to discuss your situation.

COMMON QUESTIONS

Frequently Asked Questions

Why do you need an International Tax accountant or adviser?

Working with an International Tax adviser is the best way to minimise your tax burden and ensure your business is fully compliant with strict regulations in different tax jurisdictions and your personal tax affairs are up to speed.

We are looking to grow our business overseas – can you help us?

Yes, our multilingual team specialises in supporting companies and entrepreneurs as they look to expand or relocate their business to another country outside the UK. We can manage every aspect of your International Tax planning and compliance, leaving you to focus on running your business.

What are the tax implications of moving my business to the UK?

Depending on the nature of your business and current location, you may have the choice between registering a UK-based branch or incorporating a new subsidiary. Each of these options has its pros and cons, and our specialist Tax accountants and advisers can help decide the best option for you.

Do you work with non-domiciled individuals?

Yes, we often work with non-dom residents (people who regard another country as their “home” country”). There are very specific tax rules around foreign income that apply to non-doms, which is why they should always seek the advice of an International Tax accountant when considering their personal tax affairs.

What are my options with regards to UK residential property structuring?

There is no one size fits all option and it all depends on your goals together with any short, medium and long term plans. We can consider both onshore and offshore structuring and can provide advice on the related tax implications for each of the options. Complex tax legislation needs to be carefully applied, therefore having a consultant guiding you and keeping you updated is key.

INSIGHTS

Here we share topical news, updates, and inspirational blogs.