Investing and politics – What will the UK General Election mean for investment markets?

Yesterday, Rishi Sunak called a summer general election for Thursday 4 July. While the election outcome and overall impact are unknown, there is no shortage of speculation about how the general election will impact investment markets. As such, should you be changing your investment strategy based on a Labour government, a hung parliament or the Tories pulling off a comeback that the bookmakers currently view as very unlikely?

The short answer to this is no! The only thing we can be sure of is that trying to outguess the market is often a losing game. While genuine surprises may trigger price changes in the future, the nature of these events cannot be known by investors today. As a result, it is difficult, if not impossible, to systematically benefit from trying to identify mispricing of investment markets. So it is unlikely that investors can gain an edge by attempting to predict what will happen to investment markets after a general election.

Walk down memory lane

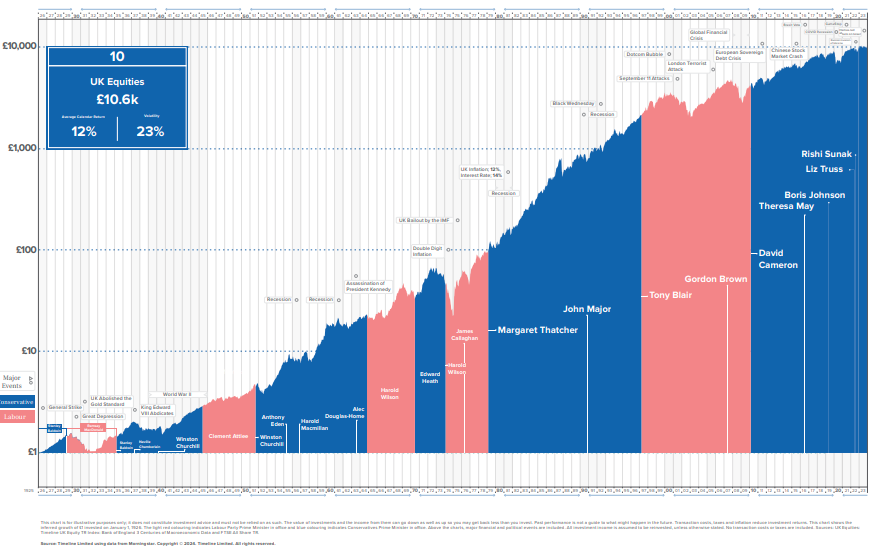

We would always advise taking a long term outlook to any investment. The graph below shows the growth of £1 invested in the UK equity market since 1925 and 23 occupants of 10 Downing Street.

There has certainly been variations in volatility under certain Premierships, with the 2008 financial crisis and Pandemic punctuating the chart. However, there does not suggest an obvious pattern of long‑term stock market performance based upon which party has the majority in the Commons. Rather, for those with a long term investment horizon it shows that the market has provided substantial returns regardless of who lives at Number 10.

Overall, trying to make investment decisions based upon the outcome of elections is unlikely to result in reliable excess returns. At best, any positive outcome based on such a strategy will likely result from random luck. At worst, such a strategy can lead to costly mistakes. Accordingly, there is a strong case for investors to rely on patience and portfolio structure, rather than trying to outguess the market.

A disciplined approach to investing

A disciplined investor looks beyond the concerns of today to the long-term growth potential of markets and markets have rewarded discipline. With this in mind, we advocate holding globally diverse equity and bond portfolios to ensure political events in one region do not overly effect the pursuit of long-term investment returns.

Our approach to investing, relies heavily on the analysis and evidence from Nobel Prize winning research. Rather than attempting to predict the future or outguess others, we draw information about expected returns from the market itself.

Next Steps

The first step towards building a robust financial plan and investment strategy is a free initial meeting to explore your current position and aspirations.

This chart provided by Timeline is for illustrative purposes only; it does not constitute investment advice and must not be relied on as such. The value of investments and the income from them can go down as well as up so you may get back less than you invest. Past performance is not a guide to what might happen in the future. Transaction costs, taxes and inflation reduce investment returns. This chart shows the inferred growth of £1 invested on January 1, 1926. The light red colouring indicates Labour Party Prime Minister in oce and blue colouring indicates Conservatives Prime Minister in oce. Above the charts, major financial and political events are included. All investment income is assumed to be reinvested, unless otherwise stated. No transaction costs or taxes are included. Sources: UK Equities: Timeline UK Equity TR Index: Bank of England 3 Centuries of Macroeconomic Data and FTSE All Share TR.

This factsheet is only for general informational and educational purposes. They are not offered as and do not constitute financial advice. You should not act or rely on any information contained in this factsheet without first seeking advice from a professional. The Financial Ombudsman Service is available to handle individual complaints that clients and financial services businesses aren’t able to resolve themselves. To contact the Financial Ombudsman Service, please visit this site. Gerald Edelman Wealth Limited is an appointed representative of Best Practice IFA Group Limited which is authorised and regulated by the Financial Conduct Authority.

Let’s get started

Contact page

Contact Us