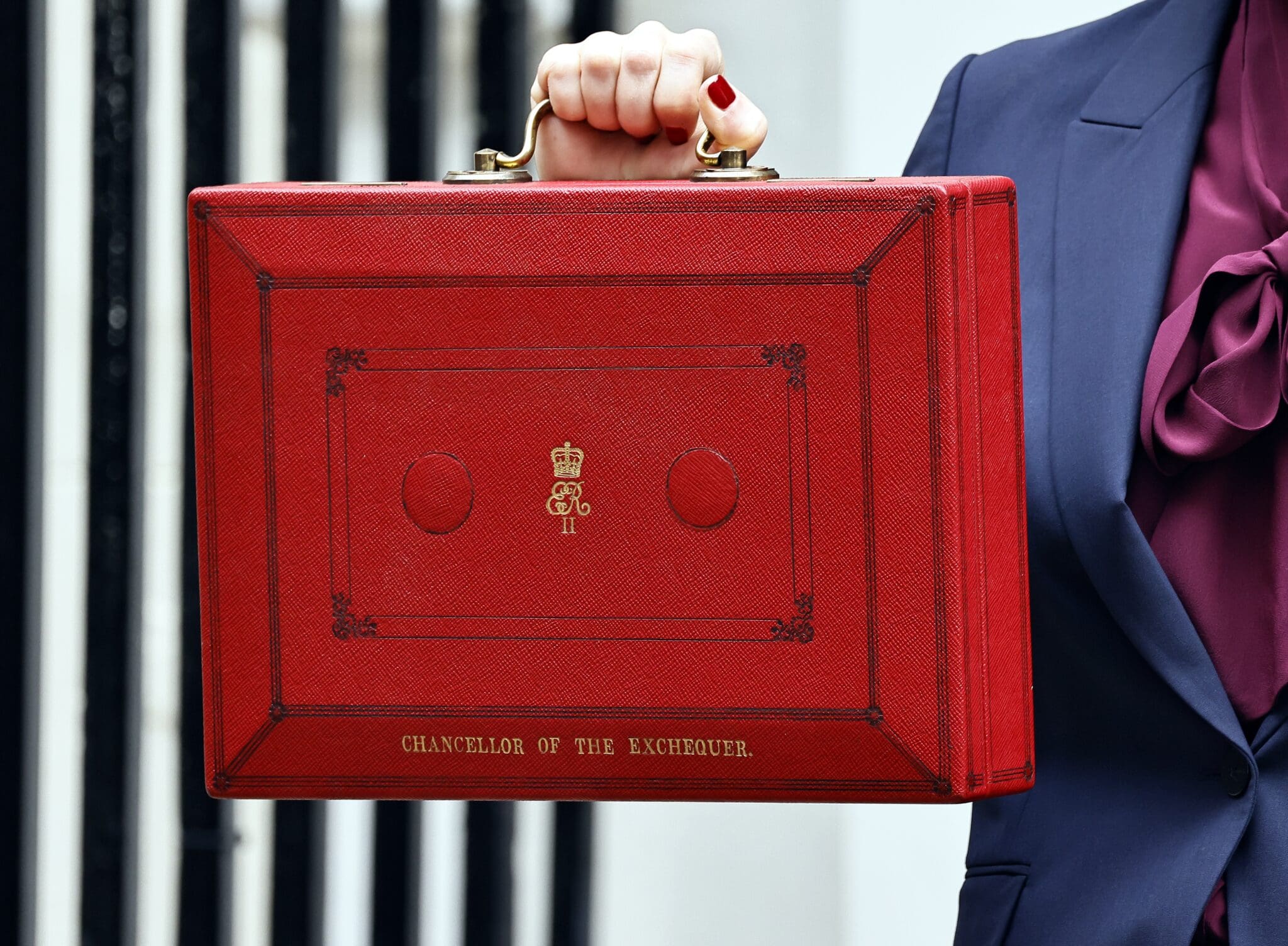

Autumn Budget 2025: Gerald Edelman partners react

With the lead up to the Autumn Budget surrounded by speculation and uncertainty, now that The Chancellor has made her announcement, we spoke to our Tax Partners to gauge their initial reaction to the announcement and the key areas of change.

Despite fierce speculation, the 2025 Autumn Budget was far from groundbreaking, which in the current climate, was a relief. Instead of the dramatic shifts the headlines braced us for, The Chancellor delivered a set of measures that aired on the side of caution but were dotted with key developments that will matter to businesses, property owners, international taxpayers and investors alike.

A focus on scale up’s

For the business community, there were signs of a quiet but deliberate push towards growth, particularly for scale-ups and entrepreneurial companies. Tax Partner, Amal Shah, noted there are several changes to be positive about. He highlighted the clear focus on improving access to Enterprise Management Inventive (EMI) schemes, which are a popular tool for rewarding employees and attracting investment. Currently, businesses with over 250 employees or £30 million in gross assets are excluded from EMI, but from April 2026 these limits will jump to 500 employees and increase to £120 million.

This single shift widens the pool of companies eligible to benefit. With the removal of stamp duty for the first three years on newly listed company shares and changes to employee share schemes under EIS, and a 40% first-year allowance on IT spending, it’s evident that the government is keen to support high-growth firms. While National Insurance increases may dominate headlines, there were, as Amal put it, some “golden nuggets of positivity” embedded in the announcements.

New pressures on property

The property sector, by contrast, is experiencing new complexities. We are anticipating that the announcement will spark a number of queries from landlords who will be looking to mitigate the 2% increase on all levels.

Our Tax Partner, Paul Attridge, anticipates a rise in individuals considering transferring their portfolios into limited companies, especially as corporate structures have avoided many of the harsher tax changes faced by individual landlords in recent years. For those already absorbing the impact from previous rounds of reforms, this Budget may be the catalyst that pushes them to restructure.

Subtle shifts to VAT

VAT policies continued on their steady departure from EU alignment, a trend that Richard Staunton, Partner and VAT Specialist described as both subtle and significant. He raised the fact that Taxi firms have been removed from the TOMS (Tour Operators Margin Scheme) following HMRC’s court loss earlier this year, which is a change achieved simply by rewriting the legislation so it no longer needs to comply with EU directives. The UK is also ending the £135 customs-free threshold on parcels entering from overseas, closing a gap that had given foreign sellers a competitive advantage.

Individually, these changes may appear minor, but they mark a decisive break from longstanding EU frameworks. This growing separation could complicate any future attempts to rejoin or align with the single market. Many VAT changes are also scheduled for distant dates, reinforcing the sense that this Budget pushes several issues further down the road.

Lingering uncertainty for international tax

From a non-doms point of view, the Budget did not reverse the April 2025 non-dom reforms. The UK has now fully moved to a residence-based tax system, not a domicile-based system and that is here to stay.

Sonal Shah, International Tax Partner, highlighted the newly introduced measure to cap inheritance tax charges that can apply to relevant property trusts which were established by non-UK domiciled individuals pre-30 October 2024. This will apply to trust charges from 6 April 2025. She explained the actual mechanics and details of this are likely to become clearer as the dust settles.

The Budget also introduced anti-avoidance measures which are yet to be published. Under the temporary non-resident (TNR) rules, changes will seek to tax “post departure trade profits” if a taxpayer is caught by the TNR rules to take effect on 6 April 2026”.

The so called ‘mansion tax’ by way of a council tax surcharge and increases in income tax on rental profits, will again affect many non-resident landlords who are renting out property, many of which are already labouring under various surcharges for being non-residents investing in property, so this will present an additional tax to pay.

Subtle but impactful changes to personal finance

In the world of personal finance, the Budget was unexpectedly subdued. David Horowitz, Head of Financial Planning and Wealth Management and Partner, explained the ISA reforms were generally welcomed as a step toward encouraging more targeted investing, especially given the limited growth potential of Cash ISAs. However, he warned that many savers still lack access to the expert advice needed to make confident, informed investment decisions.

Another small but impactful change noted by David was the amendment to salary sacrifice rules. Many squeezed professionals earning just above the £100,000 mark have relied on salary sacrifice to retain child benefit or maintain their personal allowance, which was a welcomed buffer. Removing this option hits the middle to upper-middle earners. While few may publicly defend someone earning £105k, the practical financial impact on those affected will be significant.

The mansion tax also grabbed early attention, but behind the headlines lies a logistical challenge. Valuing every property in the UK ahead of its 2028 implementation seems unrealistic.

Landlords were dealt yet another knock with a new surcharge on rental income, effectively an indirect tax rise from a government that pledged not to raise the main ones.

In terms of high earners, there were a few changes. Venture Capital Trusts saw their relief cut from 30% to 20%, reducing the attractiveness of the long-standing tax-efficient investment tool. Business Property Relief survived however, with new flexibility between spouses offering a small but welcome planning opportunity in an area that has seen tightening restrictions over recent years.

The Gerald Edelman team is here to help you navigate the world of taxation and relief. For more information on what the Autumn Budget means to you or your business, please get in touch.

Let’s get started

Contact page

Contact Us