Compliance

Self-Assessment Tax Advisers

Relieve the stress of Self-Assessment

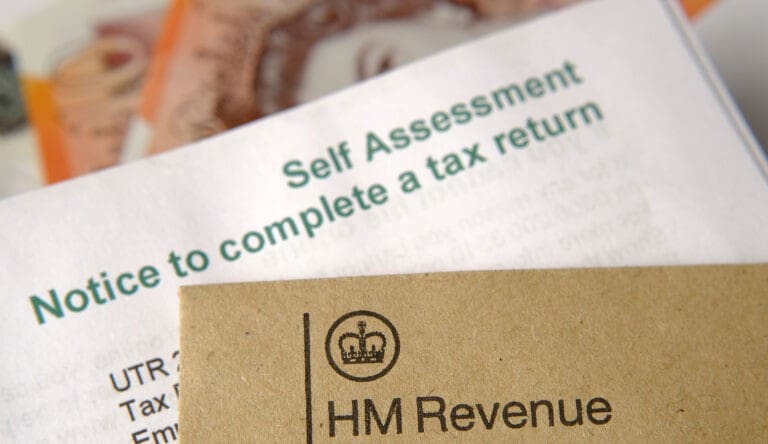

The UK is renowned for its system of complex tax codes and compliance obligations, particularly when it comes to filing annual Self-Assessment returns. As such, it’s crucial to submit your tax returns accurately and on time to avoid issues or the risk of investigation from HMRC.

Filing is your responsibility. However, there are advantages to having a Self-Assessment accountant on hand to help you, offering expertise, knowledge, and pointing out potential risks.

SELF-ASSESSMENT TAX

How can we help?

Minimise your tax liability

Our Self-Assessment tax advisers will analyse your current situation to see where tax efficiencies can be delivered and ensure you never make the mistake of overpaying on your annual tax bill.

Deliver highly accurate returns

Expertise is needed to make sure your returns are filed to the highest possible degree of accuracy, otherwise you risk submitting incorrect information which may be flagged by HMRC.

More than just compliance

We will not only keep you informed of any changes and developments that you need to be aware of, we will also be proactive in finding opportunities for future tax planning.

Get in touch

Navigating the complexity of your tax returns can be a stressful, time-consuming task.

Our friendly team of accountants for Self-Assessment are here to take the burden off your shoulders and guarantee full compliance with HMRC’s latest guidelines and tax regulations.

We’d be happy to arrange a free consultation – simply fill in the enquiry form or call us on the number below.

Call us

+44 (0)20 7299 1400Get in touch

Submit

WHY CHOOSE US

Why Gerald Edelman?

At Gerald Edelman, our team have managed the tax returns for hundreds of individuals and businesses over the years. We know exactly how to evaluate and minimise your tax liability, whilst also keeping you and your business affairs on the good side of HMRC.

You are likely obliged to file a Self-Assessment tax return if you are self-employed, a partner in a commercial partnership, a landlord, an investor, or a company director who receives income outside of PAYE. Many people also volunteer to file their own tax return in order to claim different forms of relief on their Income Tax.

If you’re looking for guidance on your own Self-Assessment responsibilities then it’s always a good idea to book a consultation with an experienced accountant to talk through your situation.

COMMON QUESTIONS

Frequently asked questions

When do I need to submit my self-assessment tax return?

You will need to submit your Self-Assessment tax return by 31 January of every year. If you are submitting a paper tax return, this needs to be submitted by 31 October.

Can I claim tax relief or allowances as part of my Self-Assessment return?

You may be able to claim tax relief or allowances on your Self-Assessment. We will always look to claim the maximum amount of relief and allowances based on your circumstances. These include, pension, charity donations, transferring marriage allowance, Buy-To-Let and mortgage interest.

What happens if I don’t file my Self-Assessment return accurately or on time?

Late submission and inaccuracies of your Self-Assessment will incur different fines. If you submit your tax return past the deadline you will receive an automatic HMRC fine of £100 – this can quickly increase as after three months you will then incur daily fines of £10 per day.

If there are inaccuracies in your tax return, it is important to disclose your mistake to HMRC before they check your return. To avoid any mistakes, we can guide you through the Self-Assessment process and ensure you submit your information on time and accurately. We can also liaise with HMRC on your behalf if you are contacted about your Self-Assessment and help to amend any inaccuracies.

Can an accountant do my Self-Assessment?

You have the option to complete and submit the Self-Assessment by yourself, as long as you follow the correct procedure provided by HMRC, and have provided all relevant information. Alternatively, you can seek help by appointing others to deal with HMRC on your behalf, such as an accountant. However, you are still fully responsible for your own tax return. So, in summary, your options are:

- Complete Self-Assessment on your own: If you find yourself in a situation where you are required to submit a Self-Assessment, but the affairs are simple and straightforward, you can choose to prepare your tax return on your own. This is usually the case where a taxpayer has straightforward income sources such as employment/interest income and is a UK tax resident.

- Complete Self-Assessment by appointing someone: Whilst you may be more than capable of doing your own Self-Assessment tax return, you may prefer the reassurance of having an experienced adviser to assist you. This is especially important when situations arise and your tax affairs may be more complicated to deal with. For example, a sole trader who has income and expenses from a large or small business to report, a taxpayer with rental income, a taxpayer who receives substantial foreign income, or even all of the above combined. This is usually where taxpayers will want to appoint an accountant to help with their returns.

Who can be appointed to deal with HMRC on my behalf?

You can authorise someone else, an “agent”, to deal with HMRC for you – for example, an accountant, friend, or relative. If you have to fill in a Self-Assessment tax return, HMRC will send all correspondence to the person you’ve authorised – except tax bills or refunds. Otherwise, HMRC will continue to write to you.

An agent can be:

- A professional accountant or tax adviser.

- A friend or relative.

- Someone from a voluntary organisation.

- They must meet HMRC’s standards for agents.

To appoint an agent to deal with your tax, you must ask them to use HMRC’s online authorisation service or complete form 64-8 and send it to HMRC. This is something we do as part of our initial sign-up process.

Why should I use an accountant for my Self-Assessment?

With the help of an experienced accountant, you will have peace of mind that your tax affairs are in good hands. An accountant can also offer advice on financial challenges you may be facing, with the confidence that you are doing things correctly.

For example, at Gerald Edelman, we go through everything you have provided and present a coherent solution based on our expertise and knowledge. We will check your bookkeeping to ensure that all sales and expenditures have been identified correctly, and remind you of all correspondence, meeting any deadlines to avoid a penalty incurring.

Finally, sometimes HMRC will raise questions about your tax return. This does not mean anything is wrong but it can cause you considerable stress and anxiety. We offer our clients the opportunity to subscribe to tax insurance which would cover our costs in the event of an enquiry being raised. This is only available on the basis we are involved in the completion of your tax return.

INSIGHTS

Here we share topical news, updates, and inspirational blogs.