Corporate Finance, Deal Advisory

Sustainable Finance – Key Trends in 2024

What is Sustainable Finance?

Sustainable Finance involves actively incorporating environmental, social, and governance (ESG) factors into financial decision-making, resulting in increased long-term investments in sustainable activities and projects.

Sustainable Finance intertwines financing already environmentally friendly initiatives, termed ‘Green Finance’, with ‘Transition Finance’. Transition Finance involves providing funding and support for businesses and initiatives to shift from traditional, environmentally harmful practices towards more sustainable and climate-friendly alternatives.

The UK government is actively promoting sustainable finance, predominantly through The Green Finance Strategy, which is a comprehensive framework setting out a roadmap for integrating environmental considerations into financial decision-making. The strategy focuses on rigorous reporting requirements combined with transparent disclosure of emissions, and a commitment to collaborating with industry partners on the development of adaptation metrics and guidance to advance and promote sustainable investment decision making.

General trends

UK Green Finance Strategy and Taxonomy

The UK Green Finance Strategy is a government initiative aimed at promoting sustainable and environmentally friendly finance practices. Established in 2019, the strategy includes rigorous ESG Corporate Reporting regulations and enhanced requirements for investment disclosure and fund labelling, while also promoting investment in environmentally friendly activities from both the private and public sectors, resulting in an estimated £23 billion of new low carbon investment delivered in the UK in 2023.

The Green Finance Strategy includes an updated approach to the UK Green Taxonomy, which establishes a framework for classifying environmentally sustainable economic activities. The taxonomy’s purpose is to provide clarity on what can be considered “green” or environmentally sustainable, helping investors, businesses, and policymakers make informed decisions about the environmental impact of their activities.

The UK aims to be a global leader in promoting green finance, and in 2023, London was ranked the leading green financial centre for a third consecutive year. Changes in shareholder values, investment preference, and legislation in the UK have created greater enthusiasm for sustainable finance, and this is supported by clear economic benefits. For example, it is estimated that every £1 spent on sustainable energy transformation will deliver a payoff between £3 to £7.

Transition Finance

Transition Finance is set to become increasingly prevalent in 2024, with new financial instruments such as sustainability-linked bonds and transition bonds providing forward-looking capital to support transition within historically less-sustainable industries.

For example, in 2021, British Airways became the first airline to receive a sustainability-linked loan tied to one of its ESG targets. The airline adopted a sustainability-linked asset-financing structure, raising $785 million to finance the purchase of seven new-generation fuel-efficient aircraft. The target aims to reduce CO2 intensity to 88.3 grams per passenger per kilometre flown in 2025 (an 8% reduction from 2019) with the company held accountable by facing a 0.25% increase on the interest rate of the loan if they fail to meet their Sustainability Performance target for the financial year ending 31 December 2025.

Sustainable Investing

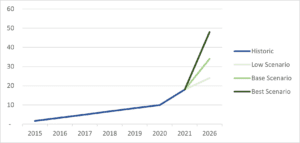

Sustainable Finance has increased greatly in popularity in recent years and is expected to generate further growth in the short-to-medium term, with increasing demand for green services and investments. This is evident when observing asset and wealth management markets, with global ESG assets under management (AUM) growing from $2.2 trillion in 2015 to $18.4 trillion in 2021, and predicted to reach $34 trillion by 2026, far exceeding the growth in traditional investment markets.

Figure 1 – Global ESG AUM Prediction ($ Trillion)

In the UK, growth is set to be supported by the sale of Green Gilts and NS&I’s Green Savings bonds, which have raised more than £26 billion to fund projects with clearly defined environmental or climate benefits since their launch in 2021.

What role does Sustainable Finance play in UK M&A?

ESG considerations are gaining significant prominence in the domain of M&A. This is fuelled by a combination of factors, including heightened political scrutiny, evolving regulatory landscapes, and a collective commitment to advancing sustainability goals. A report from The Financial Times in 2023 revealed that 83% of business leaders recognise the growing importance of ESG factors in M&A decision-making. This statistic underscores the pivotal role of ESG in reshaping how buyers assess M&A opportunities and measure their own returns.

From a deal sourcing perspective, companies exhibiting robust sustainability practices are increasingly attractive as M&A targets. This is evident in the growing significance of ESG factors in target screening and due diligence. Additionally, with the UK government allocating close to £5 billion of funding to aid businesses in achieving net zero emissions by 2050, companies capable of leveraging this pipeline of work are likely to be considered more appealing targets due to increased revenue visibility.

Another noteworthy shift in this landscape is the rising trend among financial institutions to embrace “impact investing”. This approach, characterised by seeking to generate both financial returns and measurable positive social or environmental impact, further emphasises the transformative influence of Sustainable Finance in the M&A arena.

Additional sources:

- https://www.responsible-investor.com/ri-editorial-outlook-seven-sustainable-finance-trends-for-2024/

- EU Supervisors to Scrutinise ESG Benchmark Disclosures | Global Financial Regulatory Blog (globalfinregblog.com)

- Asset managers told to clean up greenwashing and net zero claims (ft.com)

- gov | SEC Charges Goldman Sachs Asset Management for Failing to Follow its Policies and Procedures Involving ESG Investments

- https://www.corporateknights.com/category-finance/four-trends-shaping-sustainabfinance-2024/

- https://www.environmental-finance.com/content/news/european-sovereign-sustainable-bond-issuance-to-stall-or-fall-in-2024.html

- https://www.ft.com/content/915d12e7-1ff4-48c3-87c2-76b2904d03ce

- https://katten.com/go-green-or-go-home-esgs-increasing-impact-on-ma-in-the-uk-and-europe

- https://www.sseenergysolutions.co.uk/small-business-sustainability/green-grants-loans#Government%20funding%20for%20green%20business